| The CARES Act passed in 2020 as a source of relief through liquidity for small businesses or individuals and kept many businesses afloat throughout the height of the pandemic.

The SBA (Small Business Administration) has acknowledged that businesses are still struggling with the logistical fallout and changes in consumer behavior, so Carofin will continue to be a resource for the programs that may be helpful to our network. The SBA has recently announced that past or new applicants are now eligible for up to $500,000 under the EIDL program. Example: If you previously received the $150,000, this would be an additional $350,000 for your small business. What is the EIDL? The EIDL, or Economic Injury Disaster Loan, is a low interst, long-term loan to provide relief to businesses “directly or indirectly impacted by COVID-19.”

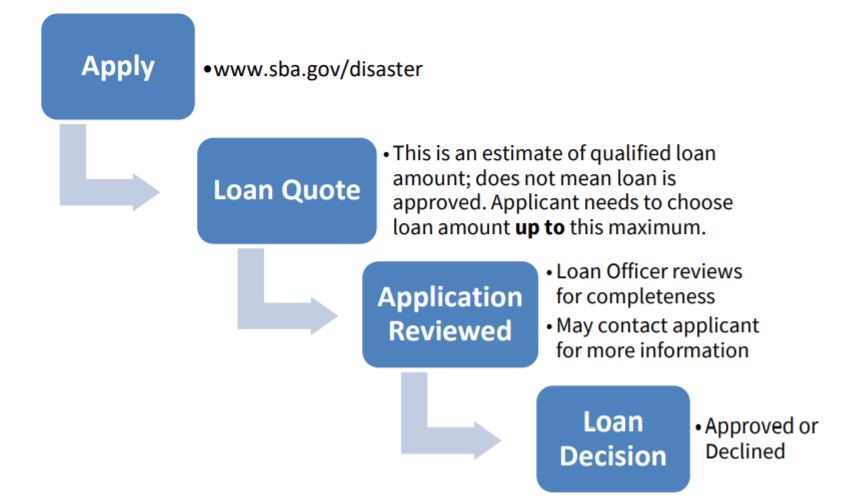

EIDL Refresher: (Click here for the SBA provided FAQ) How to apply: Apply directly through the SBA website with no need for an intermediary bank. First-time and previous applicants use this EIDL application portal. It is a short form, but don’t hesitate to reach out to our team if assistance would be helpful.

|

| Eligibility: Per the SBA’s website, “Small business owners in all U.S. states and territories are currently eligible to apply for a low-interest loan due to COVID-19.” This guidance from the SBA is intentionally broad to include:

• Cooperatives with 500 or fewer employees • Agricultural enterprises with 500 or fewer employees • Most private nonprofits • Faith-based organizations • Sole proprietorships and independent contractors Forgivable? No. PPP was forgiven if a business adhered to rules around the use of funds, but the EIDL is a traditional loan that must be paid back. Interest Rate: 3.75% for small businesses and 2.75% for non-profit organizations. Term: 30-year term to pay back the amount borrowed. Start Date: Loan payments are deferred for one year, but interest accrues during that period. For assistance in the organization of your financial information, utilize one of the many free resources in your area, and do not hesitate to reach out to us for input. Carofin and its affiliates have supported small businesses for over 25 years. They are the lifeblood of our economy, and we hope this helps support small businesses’ efforts through this difficult period. To learn more about the services we offer and the details associated with such services, please see our Customer Relationship Summary. |