Custom-Tailored Capital Solutions

Commercial Real Estate

Capital Fuels the Commercial Real Estate Sector

Being successful in the real estate industry isn’t easy. If you’re looking to grow your company, develop or acquire projects, monetize your portfolio, or launch a new fund, we’ve partnered with operators and owners to finance their strategy and accomplish their goals.

Being successful in the real estate industry isn’t easy. If you’re looking to grow your company, develop or acquire projects, monetize your portfolio, or launch a new fund, we’ve partnered with operators and owners to finance their strategy and accomplish their goals.

While Wall Street real estate investment banks work with large publicly traded companies, Carofin’s real estate investment banking group is entirely focused on private commercial real estate operators, developers, corporate owner/occupiers and CRE investment funds.

You’ve built a highly valuable enterprise. We have the expertise to structure private debt and equity securities that are tailored to your needs and engage the ideal investors to propel your venture forward.

Our competitive advantage is our ability to raise capital at the operating company, project, and fund level for a multitude of strategies. These include acquisitions, development, and redevelopment, as well as recapitalizations and real estate roll-ups. Our team can raise capital in complex situations with multiple moving parts that do not easily fit within any standard capital funding box.

We remain client-centric from start to finish, agnostic as to the solution, reverse-engineering the debt and equity capital stack that accomplishes your goals on the most favorable terms.

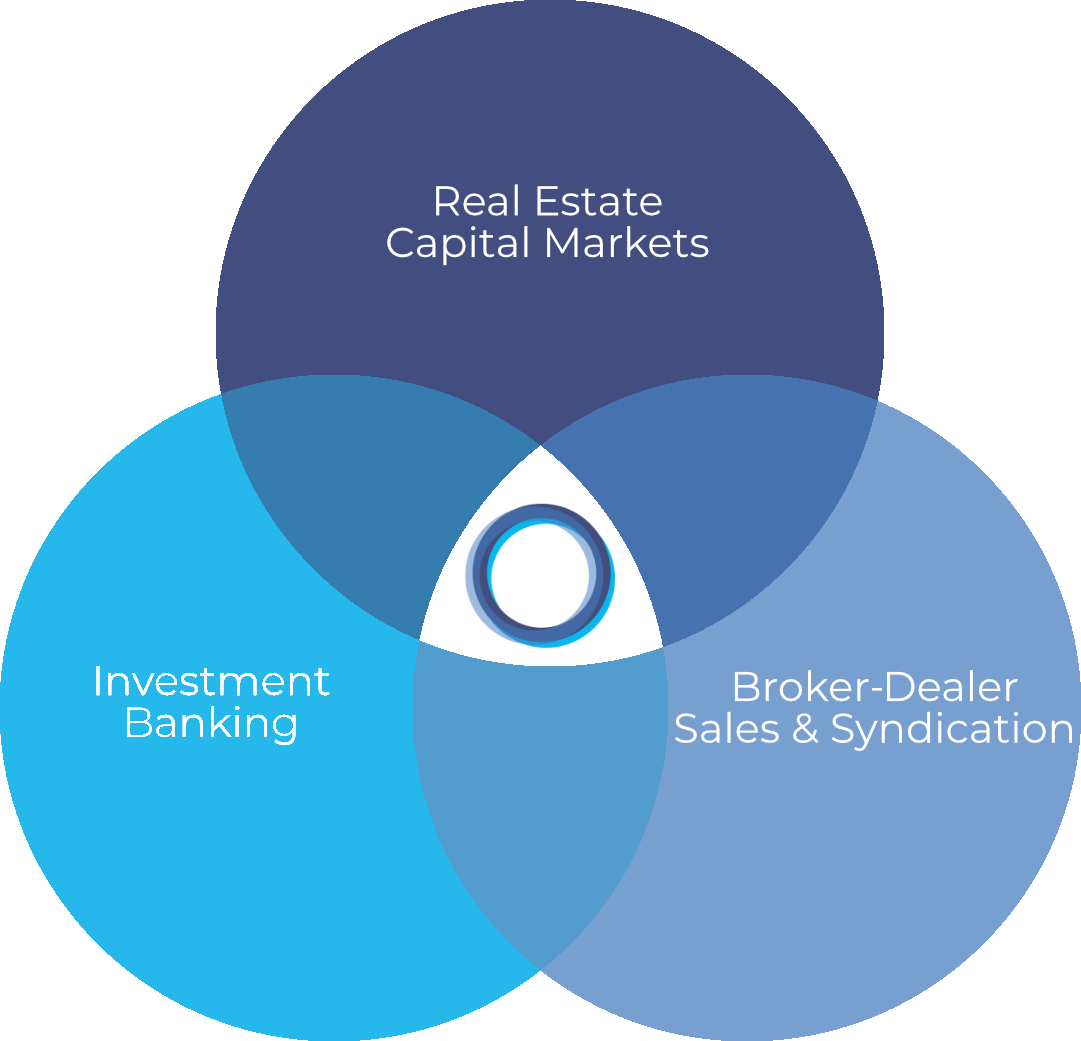

Turning Multiple Disciplines into Practical CRE Solutions

We accomplish the desired results by combining deep real estate capital market expertise with investment banking proficiency and broker-dealer syndication capabilities.

Carofin’s commercial real estate group draws upon the team’s significant real estate capital markets advisory expertise. Bringing an entrepreneurial mindset, we leverage our proprietary technology and enhanced broker-dealer syndication platform to deliver high quality executions for our private company clients and qualified CRE investment opportunities for our investors.

Consider Our Broad Investor Base

Our extensive investor base can deliver investors in many forms: high-net-worth investors, family offices, institutions, CRE LP investors, 1031 exchange buyers, as well as EB-5 and other offshore investors.

To craft capital stack solutions, our investment banking and broker-dealer syndication teams work closely to reflect real-time investor insights. We identify the most appropriate investors, drawing on decades of experience matching them to the right investments.

Developers and Operators

Delivering Bespoke Capital Solutions

Unique capital stacks designed to fund real estate operating companies, stand-alone projects, portfolios, and investment funds.

Fueling our Issuers’ Success

Debt and equity capital that funds company growth, portfolio expansion, acquisitions, new developments, and recapitalizations.

Executing on the Engagement

Securities structured reflecting market intelligence. Proven systematic processes secure maximum interest from our engaged investor network.

Dual Level Execution Capabilties

Capital to support your business’s growth strategy delivered both at the corporate and real estate levels as the engagement may require.

Redeploying Trapped Equity

Monetize capital tied up in your owned real estate using off-balance sheet sale leasebacks and real estate roll-up recaps through private placements.

Driving Supply Chain Growth

Power your warehouse network expansion by raising the required capital for new acquisitions and developments on a single or multi-project basis.

Corporate Owners/Occupiers

Investment Funds

Accelerating Fund Execution

We raise the capital for your investment funds from our accredited investors efficiently so that you can quickly begin investing.

Optimizing Investment Strategies

Leverage the real-time investor insight of our team to determine the ideal fund structure and terms to engage investor interest.

Enhancing Exit Strategy Optionality

Expand your exit strategy avenues for each maturing investment to capture maximum price appreciation and timely execution.

How We Work

We’re very selective in the businesses we choose to bring to market. We begin by conducting thorough due diligence to ensure that we present to investors what we believe to be the most worthwhile opportunities. Once engaged, our banking professionals coordinate with your team and gather the information necessary to reverse-engineer a customized security based on your (or a project’s) cash flow, and liquidity needs.

We create extensive marketing materials, reflecting the story of your company or project and its competitive position. These identify the market opportunity, pinpoint your business’s or project’s key benefits, underscore the security’s risks, and itemize the purposes of the financing for investors. With a time-tested compliance process, we ensure that all legal and regulatory hurdles have been addressed.

At this point, our sales team launches a dynamic outreach initiative, making full use of our broker-dealer platform, engaging the most appropriate network of investors. This involves direct investor communication, email solicitations, company-led presentations, and rigorous tracking of the progress of the campaign. We’re relentless in our pursuit of the capital you require for your business or project.

Post-closing, we encourage regular investor updates and communication, in many cases manage redemptions and distributions, and ensure compliance with reporting obligations and regulations. Regrettably, things don’t always go as planned. If you find your business or project dealing with unexpected challenges, we have decades of experience helping find solutions to produce mutually beneficial results.

More From Our Knowledge Base

Understanding Securities Structures in Direct Private Investments

Two fruits. Both are round, but each delivers an entirely different taste sensation and benefits to your palate. In a recent episode of the Direct Private Investments Show, proudly presented to you by Carofin, Matt Brown interviews Bruce Roberts and Garrick Ruiz about...

Multifamily Real Estate Investing

Passive investing in commercial real estate (CRE) through top-notch sponsors provides investors with current income opportunities, diversification, and potential equity upside that is not correlated to the stock and bond markets. It may provide asset depreciation...

Airbus A330 Aircraft for Teardown and Parts Resale

Carofin and Blu Miles announce a new aviation investment vehicle to finance the acquisition of an Airbus A330 aircraft for teardown and parts resale. BREVARD, N.C. and BOYTON BEACH, Fla., Aug. 08, 2023 (GLOBE NEWSWIRE) -- Carofin, a Carolina Financial Group company,...